August 1, 2013

Well beyond their impact on modern aviation, the new-to-flight Boeing 787 and Airbus A350 are wielding a much broader influence: They’re advancing the use of sophisticated composite materials across industries as a means to reduce weight while optimizing performance.

Dodge Viper image courtesy of Plasan Carbon Composites, background image courtesy of Siemens PLM Software. |

The A350 is the first Airbus aircraft to comprise more than 50% composite materials. The majority is leveraged in its fuselage and wing as part of the company’s mission to save weight and reduce maintenance costs by eliminating corrosion and fatigue. Similarly, the Boeing 787 employs nearly half carbon fiber-reinforced plastic and other composites in its airframe and primary structure. This results in an average weight savings of 20%, compared to more conventional aluminum designs, according to Boeing officials.

The widespread attention paid to both of these development efforts is turning the spotlight on composites—and illustrating how the once cost-prohibitive and highly specialized materials now have broad applicability for mainstream use.

“The Boeing 787 and Airbus A350 brought awareness to composite materials,” says Rani Richardson, a composite consultant with Dassault Systemes. “Ten years ago, when the first lacrosse stick was made with composites, no one knew what it was. It’s just a matter of awareness; now it’s not the mysterious material that it used to be.”

As familiarity with composites goes up and the price points for both the materials and production processes go down, companies outside of aerospace—including industries such as automotive, wind energy, marine and sports equipment—are actively jumping on the bandwagon and infusing composite materials into their overall design efforts. As a result, global demand for composite materials is on the rise: It’s projected to reach $34 billion by 2019, according to market research company Lucintel. The firm estimates the market value of end-user products made with composite materials was $55.6 billion in 2011, and will soar to $85 billion by 2017.

CAFE Standards Drive Composite Use

The requirement for improved fuel efficiency and demand for high-strength, lightweight alternative materials are the principal drivers behind the heightened interest in composites. In the aerospace sector, for example, manufacturers are looking to lighten commercial jetliners with composite-built fuselage and wing structures in an attempt to reduce fuel costs and increase profits.

In the automotive space, the principal push toward composites stems from revised government-mandated Corporate Average Fuel Economy (CAFE) standards, which raise the average fuel efficiency of new cars and trucks to 54.5 mpg by 2025.

Not only do composites reduce the weight of a primary structure like a fuselage or car body, but they also have an impact on the size of the other components, notes Olivier Guillermin, Ph.D., director of product and market strategy for Siemens PLM Software.

“Composites have a cascading effect on the size of other components,” he explains. For example, lighter composite wind turbine blades allows for a lighter hub, nacelle and tower to support those slimmer blades, he says.

In addition to being used to reduce the overall weight of a structure, composites also come into play to improve weight distribution. For example, a composite top deck structure lowers a ship’s center of gravity, while the lighter ends of a composite empennage on an airplane can improve overall handling, Guillermin explains.

Formability and the need to streamline parts in the quest for better aerodynamics or hydrodynamics is another reason behind the surging popularity of composites.

“There’s a growing drive within many industry sectors to use composites instead of metals, because composites are lighter and stronger than metals and can also be shaped in ways metals can never be shaped,” notes Pawel Sobczak, Ph.D., technical applications manager at Safe Technology, a maker of software that analyzes the fatigue life of composite materials. “In the automotive industry, in particular, they need to make cars lighter, but still sustain the same strength. Composites are the perfect answer to that.”

They may be the “perfect answer” today, but that wasn’t always the case. The manufacturing processes to design and produce complex composite structures have become much more automated and reliable, and ready access to cheaper computing horsepower has finally made it possible to perform composites modeling. These were both critical steps for getting engineers onboard, suggests Emmett Nelson, a software architect at Firehole Technologies. The company develops composites simulation software, and was recently acquired by Autodesk for incorporation into its digital prototyping portfolio (Editor’s Note: See deskeng.com/virtual_desktop/?p=6929).

“When composites first started, there was a lot of hand layup and manual manufacturing. Each component required a lot of human touch,” Nelson explains. “As the methods became standardized and composites production processes automated, it increased the speed and reliability of the materials, which is very important for markets like aerospace where safety is the biggest driver.”

The Acquisition Rush

While product requirements may be calling for more serious consideration of composites, the lack of available and robust design tools, particularly in the area of simulation, has been one the greatest barriers to getting engineers comfortable with the complex materials. For years, engineers have been leveraging advanced simulation tools like finite element analysis (FEA) and computational fluid dynamics (CFD) to explore the structural integrity and aerodynamics of designs built around traditional materials in the digital world prior to building costly physical prototypes. However, those conventional CAD and CAE tools have not been able to sufficiently accommodate composites modeling, which is different in that the materials are not surface-based or volume-based, but are somewhere in between.

“There are all kinds of things that go into designing with composites that require different capabilities that you don’t necessarily have with the CAD and simulation tools designed to work with basic metals,” explains Ken Amann, executive consultant with CIMdata, a market research firm specializing in engineering issues. Specifically, design engineers need to consider the type of fiber and resin, whether the design will involve long or short fibers, and how to best structure the orientation of those layers or plies—and that’s just a start, he says.

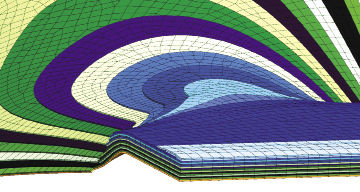

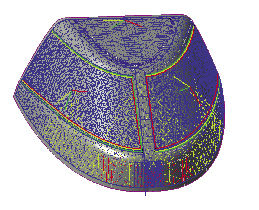

Fig 3: The layered composites add complexity to modeling and simulating composite-driven design. Shown here is a jet engine blade designed with composite laminates. Image courtesy of Siemens PLM Software. |

Recognizing both the gaps in their product lines and the escalating demand for design and analysis capabilities in this area, CAD and CAE vendors have been on a composites buying spree. In the last year, most of the major players have acquired small companies specializing in this technology area, including Autodesk’s acquisition of Firehole Technologies, ANSYS’ purchase of EVEN, Siemens PLM Software’s buyout of Vistagy, MSC Software’s acquisition of e-Xtream, and Dassault Systemes’ acquisition of Simulayt (Editor’s Note: See deskeng.com/articles/aabcxe.htm, deskeng.com/articles/aabhba.htm and deskeng.com/virtual_desktop/?p=4482, respectively).

For ANSYS, the recent acquisition of longtime partner EVEN was about acquiring both the pre- and post-processing technology for analyzing composites—including the ability to fully understand the potential failure of product models as it relates to progressive damage delamination and cracking. But the acquisition was also about bringing hard-to-find composite talent and domain expertise into the company ranks.

“The main driver to acquiring vs. building or partnering is about the speed getting into the space, but it’s also about talent,” says Sin Min Yap, ANSYS’ vice president of industry strategy. “Hiring and finding composite experts takes time and is very costly. It’s not just about the product and technology, but it’s about the people too, and mergers are a very effective way for talent acquisition.”

Fig 1: This image shows Fibersim producibility simulation results for a composite canopy. True fiber orientations are computed based on the “drapability” of the materials and the manufacturing process. Red areas indicate a likely manufacturing problem, such as fabric wrinkling or bridging. Image courtesy of Siemens PLM Software. |

ANSYS competitors Autodesk, MSC Software, Dassault Systemes and Siemens PLM Software view their composite acquisitions in a similar light. Autodesk, which had some short-fiber composites capabilities as part of its Moldflow offering, gets more advanced layered woven and continuous fiber composite modeling capabilities with Firehole’s technology. Siemens PLM Software and Dassault Systemes view their respective acquisitions as a lever to deliver a complete suite of products for end-to-end engineering of composites, from preliminary design through detailed design and manufacturing.

For its part, MSC Software’s acquisition of e-Xstream and its Digimat offering addresses one of the limitations of traditional FEA tools in this area: improving the accuracy and predictability of parts and systems FEA thanks to local, nonlinear, anisotropic modeling of the materials, according to Roger Assaker, CEO of e-Xstream, an MSC company. Consider the widespread adoption of fiber-reinforced plastics in automotive, he says: “During the injection molding process, the fiber orientations change, and that leads to anisotropic characteristics of the properties, which is important to know for the subsequent FEA that is done.”

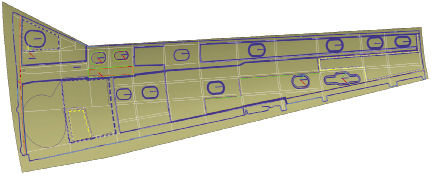

Fig 2: Fibersim is used to design the final ply shapes for complex aircraft composite wing skins, meeting the ply shape, orientation, sequence and stagger criteria set forth by the engineering and the manufacturing teams. Image courtesy of Siemens PLM Software. |

Most engineers treat fiber-reinforced plastics as metal, meaning isotropic, which doesn’t deliver an accurate representation, he says. Digimat gives engineers an accurate and smart material model to be used in FEA simulation.

“Without it, the FEA results are less accurate,” Assaker claims. “As a result, engineers tend to overdesign, which defeats the purpose of designing with fiber-reinforced plastics to begin with.”

Without tools like Digimat and specifically, Dassault Systemes’ CATIA and Simulayt, engineers can only go so far in pushing the use of composites, says Gary Lownsdale, CTO at Plasan Carbon Composites, an automotive original equipment manufacturer (OEM) supplier that makes composite parts. Plasan is using Dassault Systemes’ 3DEXPERIENCE platform and the Simulayt tool to aid in composite design and fiber modeling, eliminating the trial-and-error design process so commonplace with composites—and thus greatly reducing the number of physical prototypes.

The lack of advanced simulation tools has been a significant barrier to composite adoption, however the flurry of new simulation tools now available levels the playing field, Lownsdale says.

“When designing in metal, you can pick up any manual or go to any database to get all the physical and test properties you need to be able to design parts effectively, but when composites came along, we had to start all over again because we didn’t have those tools on the shelf,” he explains. “As those tools come online, it’s becoming much more practical for engineers to design in composites in the same way they’ve been able to design in metals.”

Beth Stackpole is a contributing editor to DE. You can reach her at [email protected].

More Info

Subscribe to our FREE magazine, FREE email newsletters or both!

About the Author

Beth Stackpole is a contributing editor to Digital Engineering. Send e-mail about this article to [email protected].

Follow DE