The latest release of COMSOL App Server tools for custom visuals so the app creator can brand the app with its own graphics. Image courtesy of COMSOL.

Latest News

April 1, 2017

Make it more affordable; make it easier to use. These two basic rules are the time-tested, foolproof strategies to promote wider technology adoption. Simulation software vendors began looking for ways to broaden their reach nearly a decade ago. Some chose to tackle it by nesting easy-to-use basic simulation tools inside standard CAD programs. Others tried delivering the product from the browser as SaaS (software as a service) offerings with pay-as-you-go pricing. Many are now looking into simulation apps—smaller, lighter, targeted simulation programs that can be used with little or no training—as the best approach.

They all address ease of use by lowering the expertise required to a reasonable level, but the proliferation of apps—in an Apple App Store-like marketplace where users can download what they need and pay a nominal fee for its use—remains elusive.

Newcomers Can Fill a Void

So far, established simulation software makers have not shown an interest in becoming app publishers. Many think they are not best suited to take on the new role, and for good reasons. First, they lack the domain expertise necessary to develop functional apps for highly targeted markets, such as IoT devices, footwear and apparel, or self-driving cars.

The latest release of COMSOL App Server tools for custom visuals so the app creator can brand the app with its own graphics. Image courtesy of COMSOL.

The latest release of COMSOL App Server tools for custom visuals so the app creator can brand the app with its own graphics. Image courtesy of COMSOL.Furthermore, their business practices and licensing policies are deeply entrenched in the development of general purpose simulation products, sold to people with considerable expertise. For example, to use computational fluid dynamics (CFD) simulation software to improve aircraft aerodynamics, you need expertise not just in aircraft aerodynamics but also in CFD software. The combo would exclude quite a few engineers from the task. Migrating from that business model to an on-demand app model could prove too risky.

The reluctance of traditional software developers leaves a void to be filled by newcomers. Boston-headquartered Front End Analytics (FEA) describes its offerings as “intelligent fit-for-purpose applications (SmartApps) that automate processes.” Simulation apps have “the ability to go outside the expert user base, to people who are in sales, in application engineering, or in design,” according to Juan Betts, FEA’s marketing director.

AweSim, a service that built upon the Ohio Supercomputer Center’s Blue Collar Computing initiative, believes online modeling and simulation apps are a critical component of its mission to provide small- to mid-sized manufacturers with simulation-driven design.

“There are customers who want access to [commercial simulation] solvers,” says David Hudak, director of Supercomputer Services at Ohio Supercomputer Center (OSC). “Then there are those who say: ‘I don’t need to understand the computer science behind the program. I just want to understand how a particular product will behave within certain confines, within certain parameters—this type of geometry, these materials and these environmental conditions.’”

New Role for Veterans

On most engineering teams, junior staff members turn to veteran employees for the setup of simulation jobs. These experts traditionally do the heavy lifting in the front end. Over time, for efficiency’s sake, they may have created guided workflows and templates for newbies to launch and use without coming to them. In the app-driven simulation workflow, the experts can take on a new role as app creator and author.

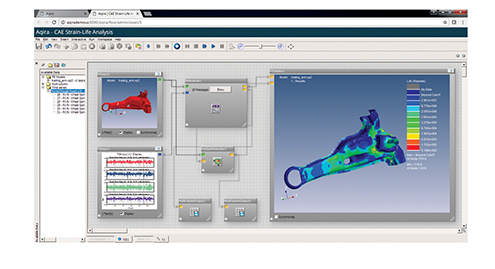

nCode’s new product Aqira includes tools for creating, publishing and deploying web-hosted simulation apps. Image courtesy of nCode.

nCode’s new product Aqira includes tools for creating, publishing and deploying web-hosted simulation apps. Image courtesy of nCode.“An expert is traditionally the go-to person to solve complicated problems,” Betts says. “They’re now starting to create apps that are distributed to junior engineers. Their expertise ensures the physics in the apps are correct, (and) the process is correct. They work with companies like us to ‘app-ify’ the process. A lot of companies are doing that internally.”

One of the difficulties an app creator faces is the challenge of capturing design analysis in a way that’s acceptable to the majority. “There’s no standard way to do a design analysis. Different people do it differently,” Betts says. “It requires some standardization to ‘app-ify’ a process for people to want to download.”

However, apps developed by companies for internal use are growing. “Useful apps are highly customized and tightly integrated for specific use cases. The apps that we’ve seen that have good adoption are those developed by a company for internal use,” Hudak says. “I don’t think that’s an accident.”

Within an established company, the design analysis protocols, the material database and the manufacturing methods are fairly standardized; therefore, they can be codified in a series of apps and templates. An app meant for public consumption, on the other hand, must account for the diversity of analysis styles, materials and manufacturing methods used by a larger set of firms.

“Suppose you build an app and bring it to a company. They’ll probably tell you your app only has material models for these types of plastics, but they work with other plastics. Material information is highly proprietary. Individual companies build their materials databases and guard those carefully. This is valuable IP (intellectual property),” Hudak says. The barriers for a simulation app for public consumption are “not impossible to overcome, but they’re significant,” he cautions.

Open Source Option

Commerce between simulation software developers and software users is relatively straightforward. A three-way commerce among the simulation app creator, the app user and the software vendor whose technology serves as the app’s engine is much more complicated. It gets even more complicated when the app-hosting platform is incorporated into the revenue-sharing scheme.

First, most simulation software developers do not currently have a licensing policy that facilitates apps—something that can accommodate the Angry Birds’ equivalent in simulation. “The ISVs’ (independent software vendors) license costs are a substantial component (of the transaction). Software license costs a lot more than computing cycles, storage and app-hosting vendor costs,” Hudak says. “If your goal is to publish a sim app to make money, you should use open source solvers if that’s an option,” he says.

Software licensing cost is usually not an issue with apps developed for internal use, because the apps will most likely be designed to draw against the pool of licenses, tokens or credits the company has already purchased in bulk for departmental use. This may be another reason apps for internal use are growing faster than apps for public use.

Publishing Tools

In 2014, when COMSOL launched version 5.0 of its flagship COMSOL Multiphysics software, the company introduced the Application Builder, a tool that lets the software user create and deliver simulation apps, complete with an application wizard for basic app interfaces. Since then, COMSOL has also launched the COMSOL Server, which can function as the backend platform for hosting and deploying simulation apps. The latest version of COMSOL Server includes visual theme customization tools, so the apps can be presented under the publisher’s own brand logos and graphics. To lower the barrier to app deployment, COMSOL priced COMSOL Server at a tenth of the licensing price of COMSOL Multiphysics, according to Valerio Marra, COMSOL’s marketing director.

“We know it’s not efficient for a company to provide hundreds of its employees with a detailed model with all its settings. They can’t all be simulation specialists,” Marra says. “There was a need to reduce complexity to make a larger group of people benefit from multiphysics simulation, but the tools weren’t there.”

The apps solve the accessibility limits by lowering the expertise required, Marra says. “Some of our customers’ apps are very sophisticated, with lots of settings, because they’re created by experts and meant for users with a deep knowledge of physics and processes, and need many inputs and outputs. Then there are apps where [the creator] has restricted the inputs to a very limited set of parameters relevant to the intended projects and users.”

But in almost all cases, “the app needs to be easy and quick to run,” according to Marra, thereby allowing others in design engineering, sales and manufacturing to conduct several analysis and evaluate what-if scenarios. Expecting such individuals to explore and master the full toolsets of a powerful simulation software would have been impractical.

In version 15.0 of its simulation software ANSYS Workbench, ANSYS introduced Application Customization Templates (ACTs) you can use to encapsulate commonly repeated simulation workflows. The company writes: “With ANSYS ACT, you can create a customized simulation environment that enables your engineering team to capture and use expert knowledge, specialized processes and best practices, improving productivity, efficiency and effectiveness. The software enables you to encapsulate APDL [ANSYS parametric design language] scripts, create custom menus and buttons to incorporate your company’s engineering knowledge, embed third-party applications, and create your own tools to manipulate simulation data.”

This month, nCode, known for its GlyphWorks data processing software and DesignLife fatigue simulation software, launched a new product called Aqira. The company writes: “Aqira enables engineering insights from more people at the right time.” It does this by providing an environment for publishing and distributing web-based simulation apps.

“We have simulation tools and test data processing tools, and a lot of experts are using it, so just getting over the interface would be a barrier for many engineers,” says Jon Aldred, nCode’s VP of product management. “So we want to find a way to enable those experts to create simplified front ends to make analysis available to others. Rather than us creating the apps, we enable customers to create the apps themselves.”

In the beginning of 2015, nCode acquired ReliaSoft, which specializes in reliability software and services. “The initial version of Aqira will focus on delivering nCode tools,” Aldred says. “Next year, it’ll expand further into reliability technology. So it’ll enable you to not only simulate the physics of failure, but also the probability of failures.”

The first incarnation of Aqira is designed as an on-premise solution (to be hosted by a company on its own servers, behind its firewalls). But the apps published from Aqira are made available to users in a web interface. “At the moment, Aqira is not SaaS,” Aldred says. “But Aqira may grow into something more externally facing. I see some benefits in that.”

SaaS Approach

In the enterprise resource management, human resource management and customer relationship management sectors, the SaaS approach has resulted in more affordable, accessible offerings. Some in simulation hope to find new users by delivering SaaS-style simulation products. Ciespace (acquired by ESI Group in April 2015) and SimScale are two such examples.

“The first obvious advantage of SaaS is that all software and hardware maintenance overhead completely vanishes—something that can be quite time- and cost-intensive with traditional licensing models and HPC hardware requirements,” says David Heiny, CEO of SimScale. “Depending on the implementation, the second not so obvious advantage is that SaaS fosters a much closer collaboration among all stakeholders of a simulation project: designers, simulation engineers, external consultants and even the software vendor’s support team. Know-how is shared easier thanks to online collaboration that ultimately gets the job done faster.”

Without the need for upfront investment in a perpetual license or powerful hardware to install and run the program, SaaS reduces barriers to simulation. But in comparison to apps, SaaS simulation still requires users to have a basic understanding of general purpose simulation setups.

“The SaaS model is more applicable to existing users,” Betts says. “Through the cloud, the SaaS model gives existing users more horsepower [in the form of virtual workstations available on demand], more multidisciplinary collaboration tools [through its cloud architecture], more integration with designers. So it does expand the footprint in terms of user base. But the focus is still the traditional engineering user base.”

The majority of the simulation apps for the public consumption will likely be delivered SaaS-style, because that’s the traditional delivery mechanism for apps. But currently, a consolidated marketplace for such apps is not yet established. The apps that have been created are scattered across vendor-hosted app stores and the creators’ own websites, with limited exposure to their prospective users.

Waiting for App Engines and New Licensing Models

There are signs that suggest some simulation software vendors could migrate into the app business by licensing their solvers as the engines behind the apps. Autodesk opened this door with the launch of Autodesk Forge, an app development platform based on Autodesk modeling, simulation and data management technologies. With it, enterprising developers could do what Sandip Jadhav, a cofounder of the Center for Computational Technologies in Pune, India, did. He launched a web-based app collection, dubbed SimulationHub, that provides custom engineering templates for simulation.

With their technologies already functioning as the de facto computation engines behind some manufacturers’ internal simulation apps, vendors like COMSOL, ANSYS and nCode are well positioned to cater to a wider group of simulation app developers, assuming they can create licensing policies that make sense for the new model.

Suppose a developer builds a drop-test simulation app to run on top of ACME structural mechanics simulation software. The developer cannot hope to sell the app for a reasonable on-demand fee if he or she needs to purchase sufficient ACME software licenses to account for every possible app user. (That number will fluctuate over time.)

The token- or credit-based licensing system (the pay-by-the-drink method, as some call it) solves some issues—but not all. In the best-case scenario, a sudden spike in the app’s usage due to popularity could exhaust all prepaid tokens, leaving the app inoperable for latecomers. What is sorely needed is an affordable on-demand licensing model that can accommodate simultaneous use of the software by an unspecified number of people on an ongoing basis. That’s the missing piece of the puzzle that can propel the simulation democratization movement to new heights.

More info:

Subscribe to our FREE magazine, FREE email newsletters or both!

Latest News

About the Author

Kenneth Wong is Digital Engineering’s resident blogger and senior editor. Email him at [email protected] or share your thoughts on this article at digitaleng.news/facebook.

Follow DERelated Topics